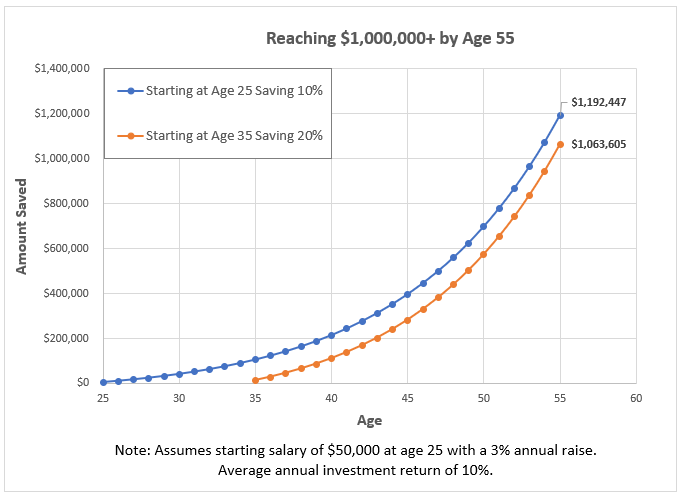

Imagine you’re 35 years old and just starting to save for retirement. You’ve tried to set money aside before, but understandably certain life events like getting married, having children, and buying a house ended up taking priority.

You’d really like to retire by the time you’re 55 years old. But to accomplish this ambitious goal, you calculate you’ll need to save up a nest egg of at least $1 million. That means you’ll have to start setting aside a 20% of your salary to get there!

Now you’re 55 years old and ready to retire. At the same time, one of your fellow coworkers who’s about your same age also announces that she will be retiring too.

The two of you get to talking and you learn something interesting: Despite both of you working the same job, earning the same salary, and using the same types of retirement investments, your coworker has been only saving only 10% of her salary.

How in the world is that possible? For the past 20 years, you’ve skimped and sacrificed in order to reach your goal. Meanwhile, your colleague has been modestly contributing half of your amount to her plan and achieved the exact same result.

So how did she do it?

The answer is simple: She started saving before you did.

And as unassuming as that may sound, few people realize how impactful that one simple action can be.

Why It’s Important to Start Saving for Retirement Now

When it comes to saving for retirement, you don’t need to earn as much money as Elon Musk or be some kind of stock-picking wizard. You just need to do one simple thing: Start saving as early as possible.

When you start saving years or even decades ahead of your peers, it accomplishes two very important things:

- You take advantage of the awesome power of compound interest. This is the money that grows on top of whatever money you’ve invested so far plus any earnings that have accumulated along the way. The more time you give compound interest to work its magic, the more powerful its effects will be and the higher your nest egg can grow.

- Because you’ll be using compound interest to accelerate your investment growth as well as putting extra years of contributions towards your nest egg, you can get away with making much smaller and more manageable contributions than you would if you started later.

This is why someone investing just 10% of their salary can easily build up roughly the same size nest egg ($1,000,000+) as a person who starts setting aside 20% starting 10 years later.

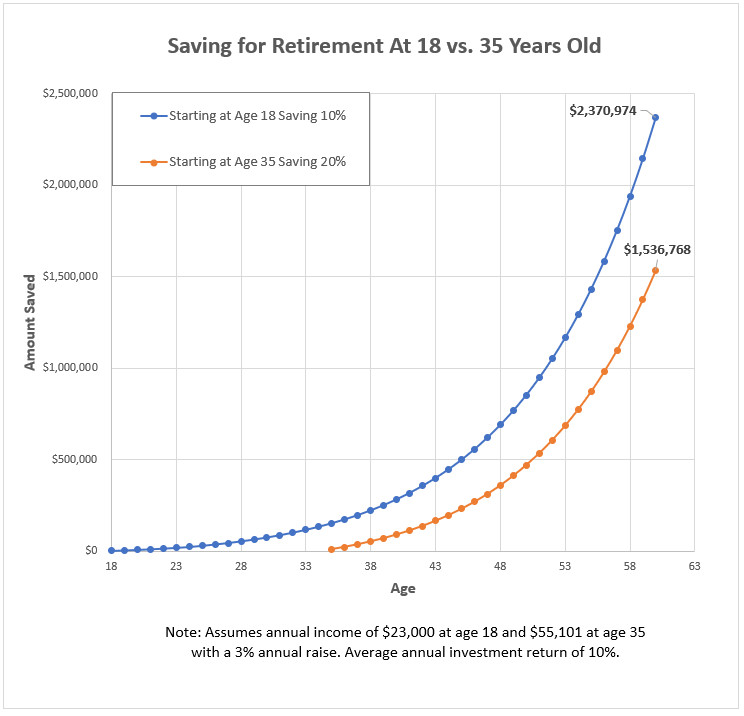

Now imagine how much money you would have had if you had started even earlier and begun saving at age 18. Additionally, instead of retiring at 55 years old, what if you waited to retire until you were 60 years old? You’d actually have $834,206 more than someone who started saving at age 35 and invested twice as much money as you. Percentage-wise, you would have 54% more money at retirement. Incredible!

Estimating How Much Money You’ll Need for Retirement

One of the biggest challenges to saving for retirement is getting caught up in determining “how much” you think you’ll need.

In reality, coming up with your number is the easy part. To figure how much your nest egg should be, simply:

- Take your current salary

- Multiply it by 80% (since you’ll probably have fewer expenses than you have now)

- Multiply it by 25 (thanks to a handy financial calculation known as the 4 Percent Rule)

For example:

- Let’s say you’re earning $50,000 right now

- In retirement, you’ll probably only need $50,000 x 80% = $40,000

- That means your nest egg target should be $40,000 x 25 = $1 million

Now you might say “$1 million! How in the world am I ever going to save up that much money?”

However, that’s not a healthy way to approach the problem.

Developing the Habit of Saving is the Most Important Step

Psychologists have long recommended that if you truly want to tackle a large goal, don’t think about the goliath-sized goal at the end. Instead, think about what you can accomplish starting today.

For instance, say to yourself “starting today, I’m going to save no less than 10% of my salary”. And then do it!

Why is that more powerful? For one thing, it helps you to get unstuck from the “how-to” part of your plan and instead creates action. With money going into your retirement plan, compound interest can start to accumulate on your investments and the magic can start.

Additionally, resolving to start making contributions proves to yourself that you do in fact have the power to start chasing after your goal. And guess what? Once you start saving 10%, it won’t take that much more effort to start saving 15%, 20%, and so on.

This is especially true as you start to mature into your career and earn more money. One of the best tricks for increasing your savings is to bump it up little by little every time you get a pay raise.

Again: Don’t miss the forest for the trees. The sooner you start taking action and focus on developing the right habits for saving money, the easier it will be.

What Are the Best Ways to Save My Money for Retirement?

To begin building your nest egg, you’re going to want to think bigger than just stuffing a few bucks every month into your bank savings account. The IRS has several great options for saving towards retirement that offer some pretty unique advantages. Here are a few you’ll want to look into.

401k Plan

401ks are some of the most widely used retirement plans available. They are what’s called an “employer-sponsored plan” meaning that your job has to offer one to participate.

The way a 401k works is simple: You decide how much you’d like to contribute to your 401k account with each paycheck. Then as you get paid, this money gets deducted from your paycheck before the taxes are calculated. That means you’re avoiding paying taxes on every dollar that you contribute to a 401k.

Over time, your money will be invested and grow. While it does, you won’t owe any taxes on it until one day in the future when you decide to withdraw it for retirement.

If tax-deferred savings wasn’t reason enough, then another cool feature of a 401k plan is that most employers will also make contributions to it on your behalf. Sometimes it’s as much as dollar for dollar.

That means for doing nothing more than simply being responsible and saving your money, you could be getting a 100% return on your effort. Plus, these additional contributions are also tax-deferred.

SEP IRA

If you’re self-employed, have a side hustle, or work for a smaller company then another type of retirement plan that you can contribute to is a SEP IRA (or simplified employee pension IRA).

SEP IRAs follow traditional retirement plan rules where you avoid paying taxes on your contributions now and defer paying them until you retire in the future. However, one big advantage of a SEP IRA is that you get to contribute to it as both an employer and an employee.

- As an employer (which is yourself if you’re a freelancer), you can contribute the lesser of 25% of your earnings or $58,000 (as of 2021).

- As an employee, you can also contribute up to $6,000 (or $7,000 if you’re age 50 or older). The only catch is that if you plan to contribute to other types of IRAs (such as a Roth), the total amount of your contributions cannot exceed the IRS limit. For example, under these rules, you could choose to save $3,000 into a SEP IRA and $3,000 into a Roth IRA because it would add up to the $6,000 combined maximum.

Contributing to a SEP IRA will let you accomplish two very important things:

- It will allow you to save more money than you normally would contributing to a regular IRA plan.

- The amount of taxes that you’ll owe will be reduced by the amount that you contributed to the SEP IRA.

For more information on SEP IRAs, please click here.

Roth IRA

Roth IRAs are a great way for individuals to save for retirement outside of their workplace retirement plans. An IRA is an “individual retirement account” and can be set up with any bank or financial institution of your choice.

With a Roth, the taxes work the opposite of a traditional 401k plan. As you save your money to the Roth IRA, you’ll have already paid taxes on the amounts you contribute.

When you retire someday and withdraw this money, you won’t owe any taxes on it or the earnings it has accumulated over the years. Basically, when it comes to your Roth IRA, what you see is what you’ll get!

Again, just like your 401k, the amount that you’ll contribute is completely up to you. As of 2021, the IRS will allow you to stash as much as $6,000 a year (or $7,000 if you’re age 50 or older) into your Roth IRA.

Be aware that for your first deposit, some financial institutions may require a minimum initial investment. (More on how you can avoid this below.)

Unfortunately, not everyone can participate in a Roth IRA. If you make too much money, the amount the IRS will allow you to contribute may be limited or phased out completely. To see if you’re eligible or not, check out the latest IRS requirements for details.

Should I Contribute to Both a Roth IRA and a 401k?

Yes! If you’ve got enough money to go around, then by all means – please contribute to both.

401k plans are great because of their simplicity. The money comes out of your paycheck automatically, so you never have to put any effort into making your contributions. Plus, between the tax-deferred savings and employer contributions, you’re going to end up with a boat-load more money than you probably would have saved on your own.

However, Roth IRAs also have some unmistakable advantages that you’ll want to take advantage of. The big benefit is that the money you’re saving is under your direct control and can be invested where you want in whatever you want. Plus, having a pool of tax-free money to draw from during retirement is definitely something you’ll appreciate.

Beyond that, if you’re ever in a true emergency and need some money immediately, you’ve always got the option to withdraw your Roth IRA contributions (the money you put into the account). Since you’ve already paid taxes on them, they are yours free to take out whenever you wish. You would, however, have to pay taxes and a 10% penalty on any of the earnings you’ve accumulated if you’re under age 59-½.

Where Can I Go to Start a Roth IRA?

If you’d like to start your own Roth IRA, you can go to any bank or financial institution and open an account. However, bear in mind that most of these places will require some type of minimum investment to get started. For example, Vanguard has an initial deposit requirement of between $1,000 – $3,000 for the majority of their funds.

If that sounds like too much, then you may want to try a robo-advisor service like Betterment or SoFi. Many of these companies will let you start a Roth IRA with just a few bucks.

Robo-advisors are nothing more than financial institutions that rely on computer programs instead of actual financial advisors to manage your money. Thanks to their simplicity and low-cost, they’ve become very mainstream and have even been giving some of the big-name financial institutions some serious competition. If you haven’t already, they’re definitely worth checking out!

Final Thoughts

If there’s one tool that everyone has to make a difference in their financial future, it’s the power to start saving “now”.

Don’t worry about how much you need. Don’t worry about how you’re going to get there. Just start simply saving “now” and turn your desires into action.

Once you do, you’ll be amazed at how easy it will be to start building upon your efforts and taking your savings to the next level. But it all starts with implementing that habit now.

Key Next Actions:

- If you have not already done so, if available, start a retirement plan through your employer.

- If you qualify based on your income, consider opening an individual retirement account, such as a Roth IRA.

- Set up a reoccurring deposit into your individual retirement account. This will help to consistently build your retirement account. Good financial habits build wealth!

- Sign up for the Expanding Wallet newsletter to discover additional ways to create wealth!

LEARN all that you can, BELIEVE in yourself, and take actions that allow you to GROW!

Get your FREE copy of the 5 Keys To Success Guide (click here).