How much of my paycheck should I be saving?

It’s a question that nearly every young adult asks themselves once they start settling into their careers and making a decent income.

There can be many ways to approach this topic. However, coming to a decision is not something that you’ll want to procrastinate. The sooner you get some figure in mind, the sooner you can start building up your financial reserves and being able to meet your goals.

Savings Rates

Since the start of the COVID pandemic in 2020, personal savings rates have been relatively high at 16.3 and 11.9 percent. However, in the decade before all of this craziness, those rates were quite a bit lower ranging somewhere between 5 and 10 percent.

Jump to 2022 and we saw a drastic drop in personal savings rates down to 3.31%. That is the lowest it has been since 2005 (2.86%). Much of this is a result of COVID-19 related provisions going away and inflation.

Of course, the purpose of saving your money isn’t to simply be on par with what everyone else is doing. You’re not everyone else, you’re “you”. Therefore, your savings rate should be tailored to your unique circumstances.

In this post, I’d like to offer my thoughts on how much money you should be saving. I’d also like to emphasize the process for determining your personal savings rate so that you can adjust it as your goals and plans change.

This post may contain affiliate links. If you purchase a product or service from an affiliate link, we may receive a small commission. This supports our website and there is no additional charge to you. Thank you!

The Popular Answer: 20 Percent

What happens when you Google the phrase “how much money should I be saving”?

You’ll get a Google Snippet as well as dozens of other articles recommending a target of 20 percent. Why 20 percent and where does this figure come from?

The 50-30-20 Rule

The 20% savings recommendation comes from a 2005 book called “All Your Worth” by Senator Elizabeth Warren. This is where she presents her “50/20/30 budget rule” (which many people also write as “50-30-20”) suggesting that a young person’s income should be split as follows:

- Needs: 50 percent of your income – Food, shelter, transportation, minimum debt payments, etc.

- Wants: 30 percent of your income – Entertainment, vacations, splurges, etc.

- Savings and debt: 20 percent of your income – Retirement, emergency fund, payments towards debt beyond the minimum, etc.

Because of its simplicity, this template has been embraced by individuals as well as financial advisors as a good starting point.

What’s Wrong with This Advice?

Inherently, nothing! In the absence of all other information, saving 20 percent of your income is probably not a bad guideline.

However, the real question is: What will saving 20 percent do for you? Will it ensure that you’ll reach your goal or not? Is there a possibility that it could be undershooting or maybe even overshooting? Until you formulate a plan, you’ll never know for sure …

Your finances shouldn’t just coast by on guidelines. They should be adjusted to fit your unique goals. To get to that point, we’re going to need to dig just a little deeper.

Side note – if you want to talk with me about your goals and finances, feel free to book a short meeting with me here.

How to Determine How Much You Should Be Saving

To come up with a personalized savings rate, I like to break down the process into three main steps.

1. What Do You Want to Do with Your Money?

Every major initiative should start with the end in mind – what is it that you hope to accomplish?

Perhaps your goal is a long-term one such as becoming financially independent or paying for your children’s college when they grow up. Or maybe you’d like to accomplish something more short-term such as being able to afford a house or supporting your new family.

Whatever your goal, write it down. Once you put it on paper, your goal moves from being this abstract idea to something real.

2. How Much Will You Need for This Goal?

The next step is to quantify how much you think this goal will cost. For instance, if you wanted to save to buy a house, then you can estimate you would want somewhere between 4%-22% of the market price of properties where you’d like to live. This would roughly be your downpayment and closing costs.

Clearly, that is a huge range, so this step may take a little bit of work and research to find reliable numbers.

However, it’s worth doing so that you’ll be better prepared to afford the thing you want.

Side NOTE: I do have a financial course for future homeowners that covers budgeting, debt management, and credit.

3. How Much Should You Save to Get There?

With a goal in mind and an estimated cost, it’s time to lay out a roadmap for making it happen.

Generally, this will be done by dividing up your main goal into several smaller bite-sized ones. For instance, saving $50,000 sounds unthinkable to some people. But when you break it down as setting aside a few hundred dollars per paycheck, the goal seems more achievable.

Your roadmap might include other actions such as adjusting your budget or taking on some side hustles to increase your income.

Remember, the more money you’re able to add to the income side of the equation, the more there will be available to save.

Again, this will be a quantitative step. But it’s also necessary so that you’ll know exactly what’s needed with each paycheck to get you to where you want to be.

Example: Saving for Retirement

Let’s demonstrate how this works with something everyone should be saving towards – a comfortable retirement.

Suppose your goal is to retire someday with the equivalent of $1,000,000 in today’s money.

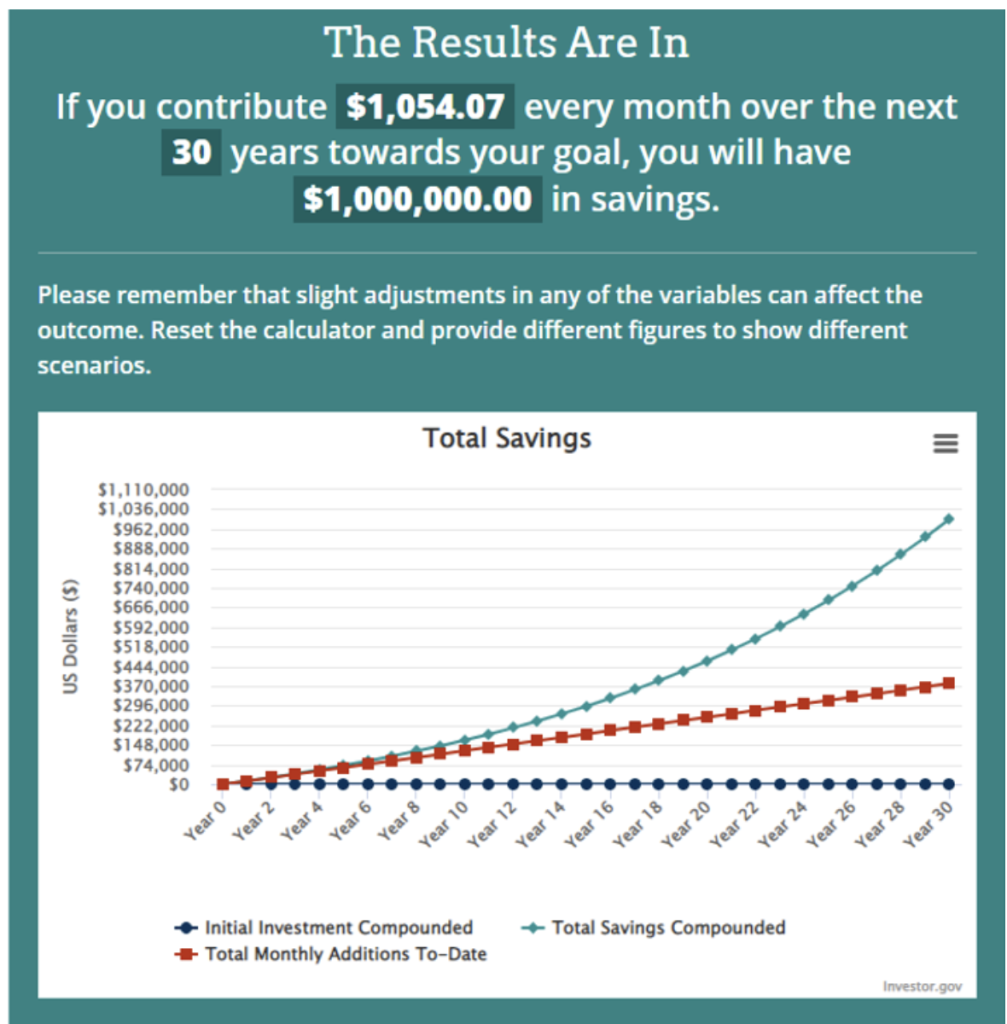

You’re 25 years old now and would like to reach this goal by the time you’re age 55. To easily figure this out, you can use a simple online calculator like this one here from Investor.gov.

Let’s also assume you traditionally invest in basic stock market index funds that have a long-term average return of around 10 percent per year. To adjust for long-term inflation, we can subtract 4 percent to get a net return of about 6 percent per year.

Inputting this all into the calculator with an initial investment of $1 (it requires you to have an initial investment greater than $0), we’ll find that you should be saving at least $1,054.07 of your monthly income to hit this target.

If your current net income is around $4,000 per month, this works out to a savings rate of roughly 26.4% of your income.

That’s of course more than the 20% guideline, but it’s also what’s needed to put you in a better position to reach this retirement savings goal.

Pro-Tip: Save Your Money Using a SMART Goal

Anytime you’re planning on setting a goal for yourself, it helps to frame it as a SMART goal.

SMART stands for:

- Specific

- Measurable

- Achievable

- Relevant

- Time-bound

Especially when it comes to your finances, a SMART goal can be particularly useful because it makes the target seem less vague and more actionable.

For instance, let’s take our earlier example and state the goal in two ways:

- Statement 1: I want to retire someday.

vs

- Statement 2: I will retire with $1 million (inflation-adjusted) by investing $1,054.07 per month for the next 30 years.

Notice how the second goal statement has a lot more meat to it?

Not only does it clearly state the goal, but it also says how you will get there and how long it will take.

Your Savings Rate Will Depend on You

Don’t be afraid to go big when it comes to your savings rate.

There are thousands of people who have been able to accomplish incredible things with their finances thanks to maximizing their earning potential and saving like mad.

Take, for example, the founder of Millennial Money, Grant Sabatier.

In his book “Financial Freedom: A Proven Path to All the Money You Will Ever Need”, Sabatier talks about a low point in his life when he had to move back into his parent’s house after losing his job.

Despite having less than $5 to his name, he set an ambitious goal for himself to earn $1 million and retire as early as possible.

Before long, Sabatier started hustling like crazy, had 13 sources of income, and began earning $300,000 per year.

At the same time, he also made a conscious decision to save around 80% of his income and invest it for growth. In just over 5 years, he reached his goal with a new net worth of $1.2 million.

Maybe your financial goal isn’t nearly as aggressive as Sabatier’s. However, if there’s one thing I want you to take away from his story, it’s level of grit and dedication that he put forth.

Think about your own goals and ask yourself: What am I willing to do differently or sacrifice so that I can accomplish what I want financially?

Keep This Key Point in Mind

Guidelines like the 50-30-20 rule are okay to use as a starting point.

But to truly enhance your chances of success, tailor a savings rate that will be sure to hit your target in the bullseye.

If you need help determining your savings rate and would benefit from having a Financial Empowerment Coach, then let’s talk.

I’d love to help you hit your goals and turn your dreams into a reality!

LEARN all that you can, BELIEVE in yourself, and take actions that allow you to GROW!

Get your FREE copy of the 5 Keys To Success Guide (click here).