Image credit: AP News

I couldn’t believe it … After two years of dodging questions and refusing to elaborate on his campaign promise to cancel some amount of federal student loan debt, President Joe Biden actually came through. Most middle-class Americans with federal student loans are going to have up to $10,000 erased!

While this is certainly welcomed news for millions of people who were struggling financially, it still leaves me with tons of unanswered questions – especially when I take a step back and try to understand how this will help the overall situation. But before we get to all of that, let’s talk about the details of Biden’s big announcement.

This post may contain affiliate links. If you purchase a product or service from an affiliate link, we may receive a small commission. This supports our website and there is no additional charge to you. Thank you!

Biden Makes Student Loan Cancellation a Reality

On August 24, 2022, Biden gave a speech from the White House that I’m sure will go down as one of the most unprecedented initiatives of his presidency. You can watch the entire announcement here.

The main takeaway from this event: Biden will use his executive authority to direct the Department of Education to forgive the following from each eligible federal student loan borrower:

- Up to $10,000 if you didn’t receive a Pell Grant

- Up to $20,000 if you did receive a Pell Grant

(In case you don’t know, Pell Grants are government subsidies awarded to extremely economically challenged applicants seeking to go to college.)

To qualify for this federal student loan cancelation, borrowers must earn less than $125,000 per year. Those who file their taxes as married or heads of households must earn less than $250,000 per year.

How Do You Get This Debt Cancellation?

Though details are still a little fuzzy, the U.S. Department of Education says that it should have its application for student loan forgiveness up and running within the next few weeks.

Make sure to sign up for updates on the U.S Department of Education site, so you are notified when the application site is up and running!

There is an application deadline of December 31, 2023.

In the meantime, borrowers should check their federal income tax return and look for their AGI or adjusted gross income. Typically, this is the figure that the government uses to determine how much money you earned and if you qualify for special programs such as this one.

Other Changes Coming to Federal Student Loans

While the $10,000 debt cancellation is the topic that’s been making waves and headlines, there were also several other positive initiatives being taken by the White House to improve the federal student loan program.

Here is a brief summary:

- One final payment freeze extension – Since the start of the COVID pandemic, federal borrowers have not been required to make a single payment on their loans. As of recently, this freeze was supposed to end on August 31st, 2022. However, Biden said he would extend it one last final time to December 31, 2022.

- Less restrictive PSLF program – When the Public Service Loan Forgiveness (PSLF) program was enacted, it was meant to attract college grads to public jobs in exchange for forgiving their loan. However, many people have called foul saying that they were denied even though they clearly had a qualifying job. Biden said he would task the Department of Education with overhauling the program and making sure that those who should be receiving the appropriate credit qualify.

- Simplified IDR plans – Borrowers who are in need have always had the option to apply for one of the four income-driven repayment (IDR) plans. However, they were so complex that most people ignored them. Now the Department of Education is proposing a new version of the plan that will be more streamlined and cut payments down to just 5 percent of the borrower’s discretionary income.

- Continuing to seek justice against predatory schools – It’s no secret that certain nameless schools made promises to their students, packed in as many as they could, and made a ton off of student loans. Some of these organizations were even so nefarious that they even shut down before the students ever received their degrees. The White House has already gone after many of the major offenders, and during Biden’s speech, he vowed to continue holding the others accountable.

Good Effort, But Not Much More Than a Band-Aid

First off, I’m happy for everyone who was in need of financial relief and is now finally going to get it. In a written statement from the White House, they estimate that this latest action will help some 43 million borrowers. In fact, for 20 million people, it will cancel their remaining balance outright. That’s awesome!

But now to address the many elephants in the room:

- What does this mean for everyone else? What about the people who sacrificed to pay off their loans or saved their money to go to college? How is this fair to them?

- Who’s going to pay for all of this? As of this writing, the national debt is already over $28 trillion!

- Is this just going to be a one-time thing? Isn’t this going to set a dangerous precedent for future borrowers?

And my biggest concern: It doesn’t address what got us into this problem in the first place. At best, this debt cancellation is just a temporary fix.

The Real Root of the Problem

The student loan debt itself isn’t the problem. Take one step back and ask yourself: Why do people have to take out such big loans in the first place?

The answer: Because the cost of college has gotten completely out of control!

Ironically, in that same written statement from the White House, the introduction talks about how the total cost of both four-year public and four-year private colleges has nearly tripled since the 1980s, even after accounting for inflation. Pell Grants that used to cover 80 percent of the cost of college now barely pay for one-third of the expense.

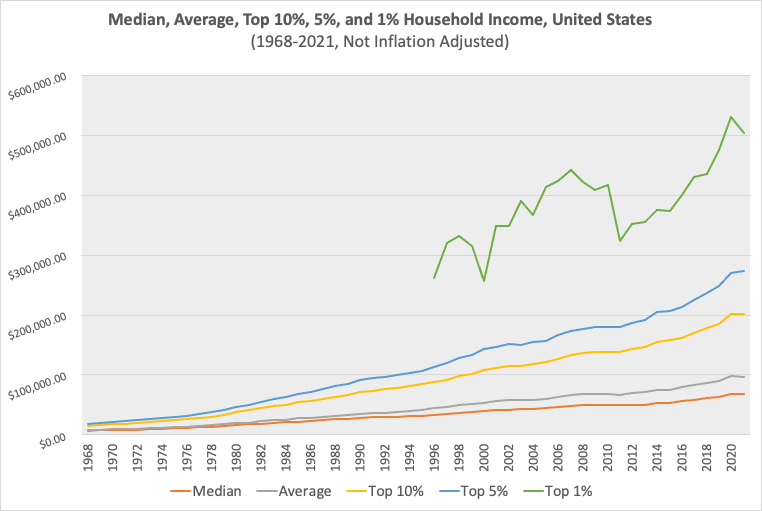

Meanwhile, pre-pandemic, the median household income in the U.S. has been stagnant for roughly the last 40 years. And that’s even after taking into account inflation.

Image source: DQYDJ

My Point

The price of college has become completely unsustainable. It makes no sense that the cost of getting a degree has gone up exponentially while American wages have stayed roughly the same.

This is the real problem that the government needs to address. In other countries such as many of those in Europe, public universities are free. This is because they value educating the future workforce over the interests of the universities.

It’s no wonder why so many young people are questioning whether college is even worth it anymore. What’s the use in getting a job that pays $40,000 per year if you have to rack up $100,000 in debt to get there? There are plenty of great paying jobs and careers that require nothing more than a certificate.

The universities need to realize that they’ve priced themselves out of the game. It would be like going to a restaurant where an average plate of food costs $500 – it just wouldn’t make any sense. And the more the government can do to intervene and find a way to divert these costs off of the students, the better.

What You Should Do

If you’ve got a federal student loan and believe you’ll qualify for debt cancellation or even one of these new programs, then by all means – you should take advantage of it! Await the Department of Education’s instructions and make that debt fall away.

However, as far as I’m concerned, this doesn’t change my overall opinion about college. Young adults need to approach college like a business decision. If getting a degree and getting a good job will lead to a high ROI (return on investment), then go for it. But if it doesn’t, then know that you’ve got other alternatives.

With that said, if you feel you want the degree and the debt that comes with it, make sure to have a financial strategy for paying off student loans. Don’t forget to take into account rising costs of expenses like rent.

If you’d like help with budgeting and managing debt then schedule a FREE consultation meeting with me here.

I’ll leave you with this quote from Benjamin Franklin:

“If You Fail to Plan, You Are Planning to Fail“

Readers – What do you think of Biden’s big student loan announcement? Does it change your opinion about college or student loans?

LEARN all that you can, BELIEVE in yourself, and take actions that allow you to GROW!

Get your FREE copy of my 5 Keys To Success Guide (click here).