Ever wondered how you could build a rock-solid credit score?

As a teenager, I attended real-estate investing seminars that focused heavily on how you could use what they referred to as OPM (other people’s money) to purchase properties.

Whether you were borrowing that money from a bank or some other source, the main takeaway was that the better your credit score the better your chance of getting money lent to you.

Plus, a better credit score typically meant they would give you a lower interest rate. Thus, you would save more money!

After learning that, while in school, I focused on building my credit score up by using credit cards.

Building my credit score up starting as a teenager played a major role in helping me to purchase a property at 24 years old.

The best part was that even though I did not have a lot of money while in school, I didn’t need a lot of money to build a good credit score.

All you need to build a good credit score is to apply a few good habits.

In this article, I’ll breakdown what factors determine your credit score, why its important, and share the habits that will allow you to build your credit score up!

This post may contain affiliate links. If you purchase a product or service from an affiliate link, we may receive a small commission. This supports our website and there is no additional charge to you. Thank you!

Why is Having Good Credit So Important?

Without a doubt, your credit score will be one of the most important numbers in your financial life. It’s the thing that can stand in between you and the things you’ll definitely want someday like a home, vehicle, insurance, cell phone, etc. You might even get passed up for certain jobs if they require a credit check.

To put it bluntly, your credit score can either open doors or close other ones. And like it or not, it’s going to follow you around forever. So, the sooner you start embracing credit and learning how to use it responsibly, the better off your financial life will be.

How Good Credit Improves Your Finances

Your credit score (or FICO score) is meant to indicate how much of a financial risk you are. Ranging between 300 and 850, the higher your score is the more you’ll be perceived as being creditworthy.

As you might guess, people with higher scores will get approved for more loans and offer better rates. But people with lower scores can expect the opposite. This can have a big impact on how much you’ll spend on certain things each month.

For instance, suppose you plan to buy a home for $300,000. Here’s how much a difference of just 100 points can affect your payment:

- With a credit score of 780, you’ll get a 4.0% rate and pay $1,146 per month.

- With a credit score of 680, you’ll get a 4.5% rate and pay $1,216 per month.

That’s an extra $60 per month or $840 per year, and will add up to a staggering $25,200 over the life of the entire 30-year loan!

And your mortgage is just one example. Think about all the other loans or lines of credit you’ll want to apply for in your lifetime. If you want to be offered the best rates possible, then you’re going to need to make sure your credit score is as high as you can make it.

Here’s how you can do this …

How to Build a Rock-Solid Credit Score History

First, take a breath … The truth about building a great credit history is that it’s really not as complicated as you might think. Especially if you’re young and just starting out with your first credit card or loan. There are just a few common-sense things to remember that will keep you on the right track.

Understand Your FICO Score

As was once said by “Art of War” author Sun Tzu, “Know thy enemy and know yourself”.

If you want to master your FICO score, then you absolutely need to know what it’s made of and how much of an impact it will have on the calculation.

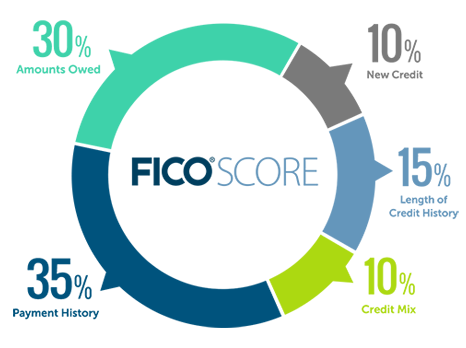

In a nutshell, your FICO score is composed of five major categories:

- Payment history (35%) – Are you making your payments on time? If you’re not paying your balance in full, are you at least making the minimum amount required?

- Amounts owed, aka credit utilization, (30%) – Are you overextended on how much of your available credit you’re using? Generally, you don’t want to exceed 25% of your credit limit.

- Length of credit history (15%) – What is the age of your oldest and newest accounts?

- New credit (10%) – Have you applied for too many new lines of credit recently or in a short period?

- Credit mix (10%) – Do you only use credit cards or do you also have a mortgage, auto loan, etc.?

The more informed you are about how your actions may affect each of these areas, the better prepared you’ll be to make the right decisions later on.

Apply for Your First Credit Card

Now it’s time to get hands-on and start actually building your credit.

If you’ve never had a credit card before, then the first thing to do is apply for one. Look for ones that cater to “students” since they generally have the lowest requirements for acceptance and will be the easiest to get approved for.

A good place to get started is to go to a reputable site like Nerd Wallet and start browsing through the different options. For instance, the Discover It and Chase Freedom student cards are both popular options that have no annual fee and will even pay you rewards points for each purchase.

Use Your Credit Responsibly

While you’re waiting for your credit card to arrive, use this time to determine how you will use your credit card responsibly and strategically.

The first thing we’re going to do is commit to the idea that you’re going to pay your credit off in full every month. Why? Since one of the factors towards building your credit score is the “Amount Owed”, if you are paying your card balance off at the end of the month then you are probably not overextending how much of your available credit you’re using.

Additionally, because any unpaid balance that carries over into the next month will accrue interest. That’s how the credit card companies make the majority of their money, and they take it straight from your pocket!

To avoid this, you’ll want to set a spending limit for yourself each month. For example, if your credit card has a $2,000 limit, then you should not spend any more than 25% or $500 for each billing cycle. This will ensure that you are within a healthy range for the “Amount Owed” credit score factor.

Next, ask yourself: Can you afford $500 per month? Perhaps your income and budget will only permit you to confidently pay off about $400 per month. If that’s the case, then you should restrict yourself to never spending more than $400 in any given month.

Once your card arrives and you start using it, make your life easy and set it up to auto-pay your balance in full. This will make it so that you never miss a single payment.

Stick with this strategy for the months that follow. Before long, you’ll have a couple of years under your belt of solid, consistent payments showing that you are not a credit risk.

Managing Your Finances to Build Credit Successfully

No matter how hard you might try, you simply won’t be able to build good credit if you don’t have the right financial fundamentals first. To do this, you’re going to want to spend some time developing useful skills and habits that will have you managing your money like a pro.

Here’s what you need to do:

Plan Your Budget

The best way to be prepared to pay your credit card or loan every month is to ensure that you’ll always have the money ready and waiting for it. This is why you need a budget.

Making a budget is really nothing more than comparing your total income against your total expense to ensure that you’re not spending more than you make. Go through the past 3 to 6 months’ worth of transactions and take note of the actual numbers.

You can build a budget using one of the premade templates in Microsoft Excel or Google Sheets. Or if you prefer you can use a helpful budgeting app like Mint or YNAB.

For more details on creating a budget then I recommend reading How to Create a Budget You Can Easily Follow.

Be Disciplined About Your Spending

Once you know how much you can afford to spend each month, your next priority should be to never exceed this amount. Monitor your spending regularly and be mindful of any large purchases that may be coming due soon (like auto insurance or travel).

By carefully ensuring that you don’t exceed the limit you’ve set for yourself, you’ll guarantee that you’ll be able to pay your credit card in full every month. This will make it so that you’ll never pay one cent of interest while continuing to build your credit history one solid payment at a time.

The Bottom Line

Credit isn’t just some luxury or service you can choose to ignore. Like it or not, it’s going to be a part of your life. And the sooner you start embracing it and learning how to use your credit responsibly, the better off you and the rest of your finances will be.

To build a great credit history, you don’t have to do anything complicated. You just have to be diligent, keep your credit utilization low, and make your payments on time. This can easily be done by creating a budget and staying disciplined to your spending limit.

You can achieve a great credit score! But it all starts with applying for that first card and then using the helpful tips I’ve mentioned above. Follow these steps, and before long you’ll happily find yourself being offered the best mortgage rates and financial services. And it will all be thanks to you being responsible.

Key Next Actions

- If you have not already determined how much you can afford to spend each month on a credit card, then start by working on your budget.

- If you do not yet have a credit card, consider using a site like Nerd Wallet to find a credit card that fits your needs (student cards are great starters).

- Once you have been approved for a credit card and receive it, be disciplined, follow your budget, and pay your balance off each month.

- Check your credit score at least every quarter and watch it rise!

LEARN all that you can, BELIEVE in yourself, and take actions that allow you to GROW!

Get your FREE copy of the 5 Keys To Success Guide (click here).

1 thought on “Build A Rock-Solid Credit Score To Save Money!”

Pingback: 3 MUST Have Reward Credit Cards In 2024 - Expanding Wallet