Have you been wanting to get into crypto but can’t stomach the turbulent price swings by Bitcoin or Ethereum? Or maybe you’re tired of investing in stocks and just want to be paid a steady but decent return on your money that’s more than the 0.1% that most banks are offering.

If the answer to both of these questions is “yes”, then you may be interested in a relatively new way to make money passively. More and more crypto platforms are starting to introduce what is known as “interest accounts”.

What are they? As the name implies, these crypto accounts offer you interest in your holdings. But not just 1 or 2%. We’re talking about some as high as 9.5%!

How? The answer lies with what’s known as a stablecoin and what these platforms do with it. In this post, I’ll explain more and go over what you need to know before you start investing.

This post may contain affiliate links. If you purchase a product or service from an affiliate link, we may receive a small commission. This supports our website and there is no additional charge to you. Thank you!

What is a Stablecoin?

Imagine for a minute that back in 2010 you wanted to buy Bitcoin. In those days, most platforms didn’t have access to traditional banking, so it was difficult for the average person to get money in or out of their systems. Before long, these platforms recognized that there was a need for a sort of “go-between” to convert fiat currency (i.e., normal money) to crypto.

Thus, stablecoin was invented. A stablecoin is a specific type of crypto where its value is backed by a reserve asset. For example, the first stablecoin Tether (USDT) is said to hold one U.S. dollar (USD) for every Tether token created.

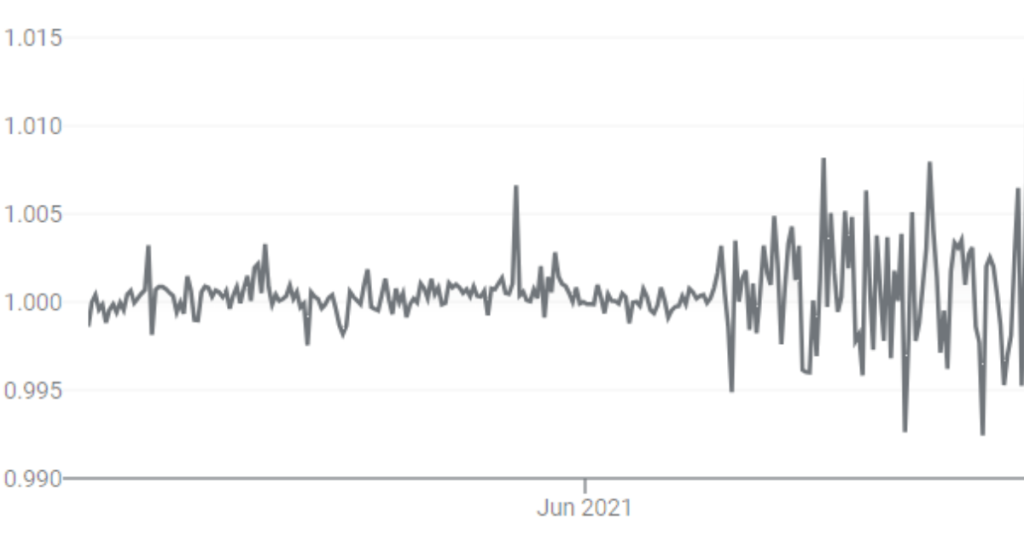

By doing this, the price of a stablecoin remains “stable”. Looking at Tether once more, you can see that on any given day the price of one token rarely ever fluctuates more than a few decimal places up or down from the nominal value of $1.

Stablecoins don’t always have to be pegged to just the U.S. dollar. It can be indexed to other fiat currencies such as the Euro or Yen. There are even stablecoins whose value is tied to the price of other cryptocurrencies (generally scaled to minimize price volatility). Stablecoins are also more commonly used nowadays to easily execute DeFi smart contracts.

Earning Interest on Your Stablecoins

At first glance, you might say: If the price of a USD based stablecoin is always just $1, then how does anyone ever make any money off of it?

The answer: Interest! Popular crypto trading platforms like BlockFi and Celsius (both based in New Jersey) are offering account owners between 8.5% and 9.5% APY on their holdings. This includes the following stablecoins:

- Tether (USDT)

- Gemini Dollar (GUSD)

- USD Coin (USDC)

- Paxos (PAX)

… and many others! You can check out the latest interest rates from BlockFi and Celsius.

It’s worth noting that these platforms will also reward account owners for mainstream crypto holdings. For instance, Celcius pays 5.35% for Ethereum and 6.20% for Bitcoin (up to a certain threshold). However, given their often wild volatility, we’ll only focus on stablecoins in this article.

How to Use Crypto Interest Accounts to Earn Passive Income

Typically, when someone wants to make an 8% to 10% return, they’d have to invest in the stock market by buying something like an S&P 500 index fund. But by doing this, they are also accepting the risk that the stock market could crash and they might lose money.

That’s the beauty of these crypto interest accounts! Knowing in advance that you’re investing in a stablecoin which should more or less always be equal to $1, there’s a slim chance that you’ll wake up and find that your account lost 10%. You should feel confident that your principal should always remain intact.

Meanwhile, hefty sums of interest will continue to pour on top of your account. All you have to do is sit back and let it accumulate.

How much interest are we talking? It’s helpful to know that payments are made several times throughout the year. For example, BlockFi makes distributions monthly. That means the longer you engage in this process, the more you’ll take advantage of the power of compounding interest.

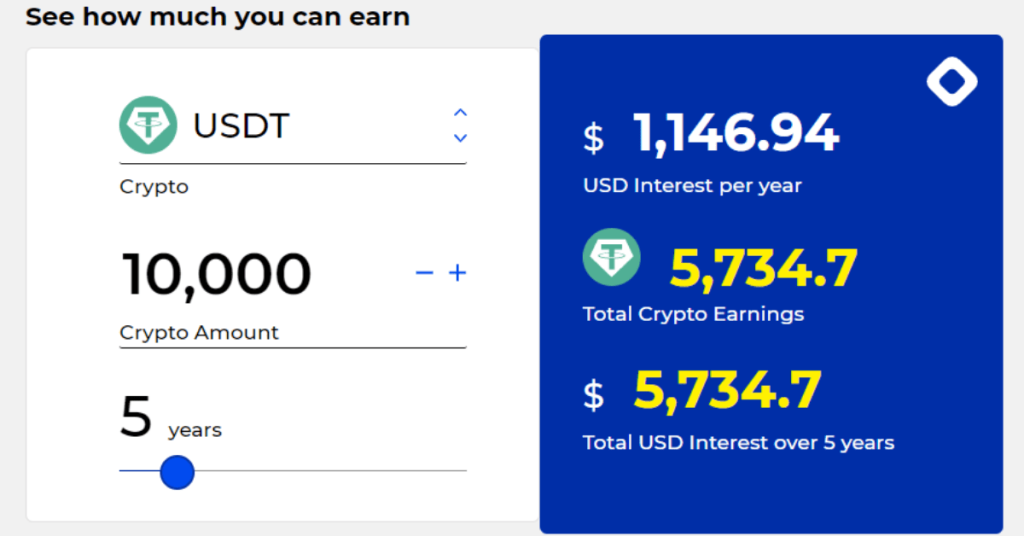

Here’s a simple example of how much you could make buying $10,000 worth of Tether and holding it for five years:

Wow! $5,735 is not a bad return at all! And remember that the best part was that it was all earned passively.

How Can BlockFi and Celsius Offer Such High Interest Rates?

BlockFi posted a very detailed and transparent response to that question in this article here. However, let me sum it up for you like this: arbitrage.

Arbitrage is when someone pays for an asset at one rate while simultaneously selling it for a higher rate. Banks do this all the time. They pay account owners 0.1% interest on their savings accounts while also selling mortgages to other folks for 4%. The difference or spread is what they make as revenue.

These crypto interest accounts are doing something similar. In the crypto market, there are mispricing gaps between exchanges and dispersed markets. BlockFi lends money to these margin traders to take advantage of these opportunities. In the end, they make some handsome profits and are then able to pay you generously for the use of your crypto.

How Risky are Crypto Interest Accounts?

If all of this sounds too good to be true, then you’re probably wondering “what’s the catch”? Since I like to make sure my readers see both sides of any situation, there are a few potential risks I can think of.

Stablecoin Stability

As we already saw with Tether, the price of a stablecoin pegged to the USD should fluctuate no more than a few decimals around $1. However, many of these tokens are not regulated and are susceptible to being hacked or even going bankrupt. There has even been some speculation that a few of the companies that claim to hold dollar-for-dollar reserves aren’t actually doing this.

The good news is that some of the major stablecoin firms are taking steps with financial regulators to be treated as a legitimate currency. For instance, in 2015, Gemini (created by the Winklevoss twins from the origin of Facebook) secured a New York state charter becoming one of the first cryptocurrency exchanges to become fully regulated in the United States. It’s subject to New York banking laws and the regulatory authority of the New York State Department of Financial Services (NYDFS).

The Trading Platform

Online platforms like BlockFi and Celsius have only been around since 2017. Though each manages billions of dollars and has hundreds of thousands of accounts, there is always the possibility that any online platform could cease operations or stop working altogether.

That may sound extreme, but it has happened. For several years, a Canadian cryptocurrency exchange called Quadriga was the largest platform in the country. Then in 2019 when the CEO Gerald Cotten mysteriously passed away, the site went down and no one could access their account. This left a quarter of a billion dollars in limbo that has never been recovered.

In Quadriga’s case, the issue was that Cotten was the only one who had the key for the accounts, and no one, including his wife, knew the password for his encrypted laptop. In defense of BlockFi, they keep the majority of their funds offline in cold storage.

Government Intervention

Perhaps the biggest but not surprising threat coming to these crypto platforms is impeding regulation. For years, politicians and government officials have targeted cryptocurrency demanding that the platforms provide information about their users, the transactions, and follow more traditional methods of banking.

In July 2021, security regulators in Alabama, Texas, New Jersey, Kentucky, and Vermont brought actions against BlockFi claiming that the company was offering unregistered securities. Similar allegations were brought against Celsius in September. Around this time, Coinbase was considering offering interest accounts but then abandoned the idea.

As it stands today, investors can still go to either BlockFi or Celsius and open a new interest account. However, we’ll have to wait and see how the threat of regulations shapes these companies in 2022.

Investing Always Carries Risk

With all of these potential risks, is it worth it to open a crypto interest account? From my perspective, I’d say absolutely!

The main thing to keep in perspective is that these are not “savings accounts”. There’s no FDIC insurance or protection if the stablecoin or trading platform gets into trouble. You could possibly lose all of your money.

But isn’t that true about any investment? If I buy stock and the company runs itself into the ground, couldn’t I also lose everything? Absolutely!

To me, earning a guaranteed 8.5% to 9.5% return with virtually no loss of principal is more than anyone could ever ask for. However, from the sound of things, some caution is needed as regulators could make significant changes to stablecoins.

Reader: What are your thoughts on stablecoins as a passive investment source?

LEARN all that you can, BELIEVE in yourself, and take actions that allow you to GROW!

Get your FREE copy of the 5 Keys To Success Guide (click here).