Like it or not, your credit score is like your shadow – it follows you no matter where you go. The only difference is that your shadow doesn’t determine whether or not you qualify to buy a house or can be trusted to handle a credit card!

One of the things that pains me is when people ignore their credit score or do things that might sabotage it. The world, unfortunately, makes very swift and harsh judgments about you based on your number, and the doors of opportunity can quickly close if you don’t make the cut.

Therefore, it’s always in your best interest as well as that of your loved ones to do everything in your power to make your score as high as possible. In this post, I’d like to walk through a few examples of the difference a credit score can make in your financial life.

This post may contain affiliate links. If you purchase a product or service from an affiliate link, we may receive a small commission. This supports our website and there is no additional charge to you. Thank you.

What’s Considered a Good Credit Score?

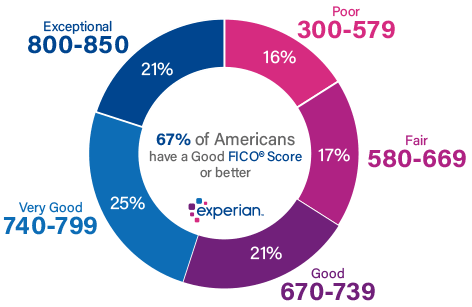

Your credit score is a unitless number between 300 and 850 that indicates your creditworthiness. It uses a variety of data and factors from your credit history to determine how likely you are to use your credit line responsibly.

You’ll often hear your credit score referred to as your FICO Score. This is because it’s calculated by the analytics software company Fair Isaac Corporation.

Though these brackets may change depending on the lender, FICO Scores are generally categorized as follows:

- 300 to 579 = Poor

- 580 to 669 = Fair

- 670 to 739 = Good

- 740 to 799 = Very Good

- 800 and up = Excellent

How Your Credit Score Impacts Your Financial Future

While some people may think that their credit score is only important if they want a loan or new credit card, nothing could be further from the truth. Yes, you do need a high FICO Score to get those things. But that’s just the tip of the iceberg.

Having an awesome FICO Score can give you access to a whole host of financial products and rates. Those can save you thousands of dollars or add more to your monthly bottom line.

Here are three examples of how having a great credit history can give you a big boost financially.

1. Saving Tens of Thousands of Dollars in Mortgage Interest

Every year, thousands of mortgage applications are rejected due to poor credit. However, something that’s not often discussed is when people get approved but are offered a higher-than-average interest rate.

The interest rate you see advertised online or in the news can be thought of as the “best” rate for people with excellent credit. However, if your credit score is less than superior, then the mortgage company can charge you a higher interest rate. And you’d be surprised what a difference of just 100 points on your credit score will make!

To illustrate this, check out this scenario from Nerd Wallet:

- Suppose someone wants to buy a $300,000 house and is prepared to put down a 20% down payment. This means that they’ll be taking out a 30-year fixed-rate loan for $240,000.

- With a FICO Score of 780, let’s say the borrower qualifies for the best rate of 5.00%. This would equate to a monthly payment of $1,288, not including taxes, insurance, or homeowners’ association fees.

- What if that same borrower had a FICO Score of 680? The lender might now offer a rate of 5.50%. This would equate to a monthly payment of $1,363. That’s an extra $75 per month or $900 per year.

- The biggest devastation comes when you look at how much is spent over the life of the loan. If these two payments continued for 30 years, then this 100-point credit score drop would ultimately cost an additional $27,000!

What’s worse is that the story doesn’t stop there. What if you want to refinance in a couple of years to a better rate or shorter-term? Again, you might not have the ability to do this unless your credit score meets their standards.

READER: If you dream of owning a home and want to get your financial house in order, check out this Expanding Wallet course.

2. Racking Up Credit Cards Rewards

Obviously, you need a good credit score before you can apply for a credit card. But something a lot of people do not realize is that if you’re exceptionally good at managing credit cards, then there’s a lot of money to be made.

How? Credit card rewards!

Credit card rewards are generally earned in one of two ways:

- The issuing company will have some kind of rewards system where every dollar you spend earns one or more points. Those points can then be redeemed for cash, credit, gift cards, or even travel.

- The card may also have a special promotion where new members will receive a huge bundle of points after they meet some initial spending requirements (like spending $4,000 within 3 months). Those welcome bonuses can be worth anywhere from $200 to $1,000, or sometimes even more depending on how they are redeemed.

This is not an opportunity to be taken lightly. About 10 years ago, a blogger named Brian Kelly started a website where he started sharing how he was accumulating credit card rewards to take first-class flights, stay at exotic hotels, and get all kinds of cool free stuff. Today, his blog The Points Guy has evolved into a lifestyle media brand that attracts 10 million unique visitors a month.

Kelly isn’t the only one to exploit credit card rewards for all he can. There have been dozens of other incredible success stories:

- Richmond Savers – How to Take Your Family to Disney World for Free

- My Money Design – How to Fly to Hawaii on Points – We Saved Over $5,000!

- CNBC – I earned $1,734 in credit card rewards last year—here’s how you can, too

- The Motley Fool – The Average American Could Earn Over $650 per Year in Credit Card Rewards

You can see this for yourself. Browse through this list of the top rewards cards and what do you notice? Almost all of them say you need Good to Excellent credit.

So, what’s the main qualification you need to get the right credit cards and earn rewards points like these?

The answer: A great credit score of course.

3. Your Ability to Qualify for Other Necessary Loans

Chances are that credit cards and a mortgage won’t be the only loan you ever apply for in your lifetime. There may be several others that you’ll eventually need such as:

- Home equity loans or a HELOC

- Auto loans

- Student loans

- Personal loans

- Business loans

For example, you may not be thinking about it now. But someday you may want to start your own small business. When that time comes, you may need to apply for a loan so that you can get the capital needed for equipment, a building, wages to pay your employees, etc.

However, none of that will be possible without having a good credit score.

The unfortunate truth is that no matter how entrepreneurial you are, if you can’t demonstrate financial responsibility by having a decent FICO score, then it’s going to be very challenging to get the help you need.

The best thing you can do is to never let this become an obstacle by deciding right now to use credit responsibly and putting yourself in a position to qualify when the time comes.

How to Improve Your Credit Score

Whether you’re looking to fix your credit or want to go from good to excellent credit, there’s always something more you can do. The good news is that as complicated as some people would like you to think credit scores are, it’s really not rocket science.

The single best thing anyone can do to fix their credit is this: Turn on their monthly Auto-Pay feature and select “pay my balance in full”. This one move is great because it accomplishes so much:

- You’ll never miss a payment because it will always be paid on time automatically.

- You’ll never be less than the minimum payment amount because you’re always paying the full amount. (Also, since it’s the full amount, you’ll never incur interest.)

- Your credit utilization will be better off since you’re continuously resetting your balance.

And that’s just the beginning. There are lots of other small actions you can take that will have a big impact on your FICO Score. Click here for more great tips.

How to Check Your FICO Score for Free

Have you checked your FICO Score recently? Or ever?

If you want to find yours, there’s an easy way to do it without having to pay any money. You can create a free account with Experian (one of the three major credit card bureaus) and they will share your actual FICO Score (and not some alternate version of your credit score like other sites).

Remember: Your credit score is your number. It’s based on your ability to make payments and prove that you’re a trustworthy candidate. The sooner you embrace this concept, the sooner you’ll own your credit score. And once that happens, you’ll find out just how much your finances can flourish thanks to responsibly using credit.

LEARN all that you can, BELIEVE in yourself, and take actions that allow you to GROW!

Get your FREE copy of the 5 Keys To Success Guide (click here).