If you’ve been paying attention to Bitcoin lately, then you might have noticed that it recently reached an all-time high price of $66,974.77 on Oct. 20, 2021. That’s a monumental climb from 11 years ago when it was only worth about 10 cents.

And there’s no end to the enthusiasm. Talking heads throughout the media have all kinds of forecasts about where it will go next. For example, billionaire venture capitalist Tim Draper has made the bold prediction that Bitcoin will reach a value of $250,000 by the end of 2022. This is mainly because he believes it will be “much more in use by then”.

While the prospect of making gains from your investment can be very exciting, be careful! You may inadvertently convince yourself that cryptocurrencies are a sure thing. But if you start to go in that direction, then I encourage you to pump the breaks!

Bitcoin and other cryptos have taken quite a wild ride over the past decade. The climb upwards has been anything but all uphill. In fact, just this year alone, Bitcoin lost nearly half its value falling to just over $30,000 in July after it hit its previous high.

As is true with most investments, there’s never a guaranteed return. They all come with some element of risk; some a lot more than others. And given how new cryptocurrencies are, I believe this is especially true.

That’s why in this post, I’d like to explore three potential dangers that you need to consider before investing in crypto. Let’s go beyond the typical risks of price speculation and value fluctuations. Instead, I want to look at the crypto market as a whole and some of the challenges that potentially put your money at risk.

This post may contain affiliate links. If you purchase a product or service from an affiliate link, we may receive a small commission. This supports our website and there is no additional charge to you. Thank you!

Issue 1 – It’s Too Early to See Clear Winners

Without a doubt, Bitcoin has been the super-star in the crypto space. But it’s far from being the only digital currency that people are investing in.

To put numbers to this, here’s a breakdown from Forbes of the top 5 cryptos and their market capitalization:

- Bitcoin (BTC) Market cap: Over $1.17 trillion

- Ethereum (ETH) Market cap: Over $520 billion

- Binance Coin (BNB) Market cap: Over $88 billion

- Tether (USDT) Market cap: Over $70 billion

- Cardano (ADA) Market cap: Over $66 billion

And that’s just the beginning. As of October 2021, there are actually 6,826 cryptocurrencies worldwide. That’s up from just 644 five years ago. Without a doubt, this is a space that is quickly getting crowded!

How Many Will Still Be Here 5 Years from Now?

With all of the new cryptos that keep coming on the scene, one has to wonder: Could some of them have been created with less than pure intentions? Are they here to simply cash in on the crypto craze and take advantage of naive investors?

Unfortunately, this may be true. Ever heard of Dogecoin? You know … the one with the Shiba Inu dog from all the Internet memes? Believe it or not, it was created as a joke back in 2013 by a pair of software engineers. It wasn’t until recently when Elon Musk started tweeting about it that people started buying it, even though no one really knew what to do with it.

Then there are skeptics of the crypto market as a whole. Take Nouriel Roubini, the New York-based economist who successfully predicted the 2008 financial crisis. When asked about digital currency, “Dr. Doom” as he’s been dubbed claimed that 99 percent of cryptocurrencies are worthless. He even went before Congress to state that cryptocurrencies are the “mother and father of all scams and bubbles”.

If what Dr. Doom says is true, then this reminds me of a similar sequence of events that took place 20 years ago: the dot com bubble. This was a time when the Internet was just becoming a household thing, and the world was excited about the possibilities of e-commerce.

Everyone and their brother was starting a new “tech” company. It didn’t matter if they had a business plan or even made a profit. Investors were pumping billions into these new e-commerce companies on the defiant belief that they would get rich. But, as you can imagine, reality soon set in, and a lot of those companies went belly-up. This threw the entire economy into a recession that lasted for several years.

In all fairness, not all companies from the dot-com era were flops. We still have some of them today:

- Amazon

- eBay

- Priceline

The same will be true with a few select cryptos. But which ones will they be?

Issue 2 – A Litany of Security Issues

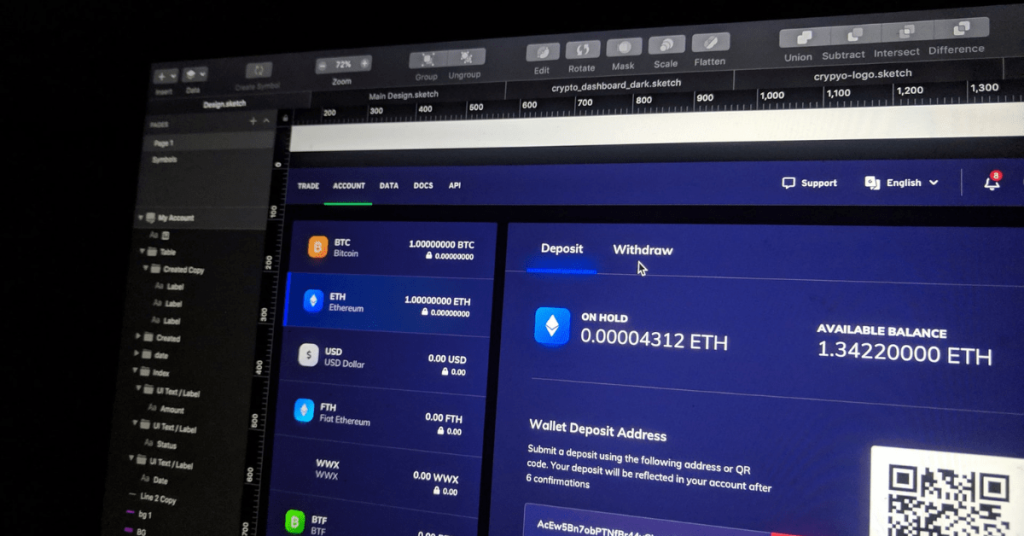

Crypto enthusiasts have long promoted it as ultra-safe and virtually unhackable thanks to the way that blockchain technology works. However, that does not mean that the crypto trading platforms themselves don’t have vulnerabilities!

The most noteworthy crypto breach came in August 2021 when hackers stole more than $600 million from the DeFi platform Poly Network. This was a service that was supposed to help various crypto blockchains work together so that investors could more easily exchange one crypto for another. Unfortunately, hackers found a way to exploit a vulnerability in their system, and that allowed them to commit the largest cryptocurrency theft known to date!

To everyone’s surprise, the hackers did eventually return about half of the stolen crypto. Speculation from authorities was that even though they had managed to steal the assets, they didn’t have a plan for how to launder that much money into accounts that they could actually use.

While that was a positive twist to the case, there have been several others where the outcome hasn’t been so good. In most cases where hackers take your money, they disappear into the void of Internet anonymity where they’re never heard or seen from again.

Unfortunately, when this happens, it’s not like when your bank account or credit card gets hacked. There’s no one to call. No claim to make. No insurance to recover your funds. The money is just plain gone.

I’ll touch on the best way to protect your cryptocurrency shortly.

Crypto Investigators on the Case

Some people in the world of cyber security recognize that as crypto becomes more mainstream, hacking is only going to be a problem that grows larger with time. And they’re prepared to step up to the challenge.

This is one of the reasons that Pawel Kuskowski started the blockchain sleuthing firm Coinfirm. During an interview with Coindesk, Kuskowski talks about how he’s teamed up with global investigations firm Kroll, a division of consulting firm Duff & Phelps, to help take on hackers and give the victims some form of recourse.

While this is a good first step, keep in mind that just like the FBI and FTC, firms like this will usually only have the time and resources to go after the “big” crimes. The ones where millions of dollars have been stolen. For the smaller stuff, you can certainly file a police report, but it seems highly unlikely anyone is going to have the capacity to help you or provide much assistance.

Physical Wallets of Digital Currency

Perhaps one of the best ways to protect your all-digital investment is to use something non-digital – like a physical key. Some crypto platforms are having their members use so-called “cold” wallets – a USB-like device that contains a password-like bit of code called a private key that allows you to access your crypto.

While it would be almost impossible to hack (since a thief can’t make you plug in this hardware to your computer), it does introduce another obvious risk: What happens if you lose your wallet? If it gets misplaced or you forget your password, then the contents of that wallet might never be recovered.

If you are interested in a hardware wallet (a form of a cold wallet) to store cryptocurrency, consider getting one from Ledger.

Issue 3 – The Uncertainty of Government Regulation

It’s important to keep in mind that as much as we hear about crypto in the media, it’s still a relatively new technology. And many countries and government agencies simply have no idea how to tackle or manage it.

For some, the answer was fairly simple: ban cryptocurrencies altogether. Take places like China and Northern Africa (Egypt, Morocco, Algeria). In these countries, crypto is completely illegal.

Other places have mixed rules. In Arab nations like Qatar, Saudi Arabia, Jordan, you can own crypto. However, it’s been banned from use with banks. So, it’s not as interchangeable.

Still, many countries around the world now see the demand for Bitcoin and other cryptos as becoming too great to be ignored. U.S Federal Reserve Chairman Jerome Powell has stated that he has “no intention” of banning cryptocurrency.

However, even in those places where crypto has been embraced, they still have to figure out how to regulate it and more importantly tax it. As a matter of fact, the $1 trillion bipartisan infrastructure bill that is moving through Congress right now has all kinds of cryptocurrency regulation tucked inside of it.

For example, the definition of a brokerage would be expanded to include companies that facilitate the digital trading of assets (aka cryptocurrency exchanges). There would also be rules about how stablecoins operate. All of this would mean increased red tape and more tax reporting to the IRS.

Government Issued Crypto?

Perhaps the biggest threat to Bitcoin and other cryptos is the uncertainty of what will happen if the U.S. government decides to adopt its own version of a digital currency. And that’s a reality that might not be that far off.

Chairman Powell said earlier this year that exploring digital dollars was a “high priority project”. It’s been hinted many times that the U.S. has been considering creating a CBDC or “central bank digital currency”. Supporters of the idea say it would allow the government to more easily track fraud, influence financial policy, and prevent volatile cryptocurrencies from undermining the economy.

You can almost be certain that if that happens, the U.S. isn’t going to tolerate competition from other rogue cryptos. They would either be phased out or taxed to the point where the only sensible option would be to use the U.S. version.

Summary

Bitcoin and other cryptos may have taken investors on a pretty wild ride over the past decade. But as they grow in popularity, there will be a lot more to the story than whether or not they go up or down in value.

Taking into consideration all the things mentioned in this article, thinking logically would be a good course of action. If these were stocks or any other type of investment product, how would you approach them? Would a crowded market, security issues, or pending government regulations make you nervous?

As with all new investments, a few people will put in their money at just the right time and get lucky. But that doesn’t mean anyone who blindly throws money into the crypto markets will automatically get rich. Be careful and remember that a sensible approach is always best.

If you want to learn more about Bitcoin, the first cryptocurrency, read Is It Time to Pay Attention to Bitcoin?

Key Next Actions:

- Research and understand cryptocurrency like any other investment.

- If you are planning on investing in cryptocurrency, consider protecting your crypto by getting a cold wallet.

- Check out the Expanding Wallet YouTube channel for educational videos and insightful interviews.

LEARN all that you can, BELIEVE in yourself, and take actions that allow you to GROW!

Get your FREE copy of the 5 Keys To Success Guide (click here).

2 thoughts on “Considering Investing in Crypto? Beware of These 3 Issues”

Great tips for investing in Crypto. Thanks for sharing with us. I believe learning about crypto investing is must before investing.

No problem! Learning about any investment before investing is always smart.